Flipping Non-U.S. Companies to Delaware C-Corps: A Guide for Attracting U.S. Investment

In the world of venture capital and startup investment, Delaware C-Corps have become the gold standard for companies seeking funding from US investors. In this blog post, we will explore the reasons behind this trend, the steps involved in the process, and the top considerations when structuring a "Delaware Flip" for international companies.

Why Delaware Flip?

There are several reasons why startups and investors prefer Delaware as the jurisdiction for incorporating a company and setting up a C-Corporation:

Business-friendly environment: Delaware is well-known for its business-friendly laws and regulations, as well as its efficient and specialized Chancery Court, which focuses on business litigation.

Flexible corporate structure: Delaware C-Corps offer a flexible corporate structure that allows for different classes of shares, which can accommodate the needs of various types of investors.

Familiarity and predictability: US investors are typically more comfortable investing in Delaware C-Corps due to their familiarity with the legal framework and the predictability of outcomes in potential disputes. Many US investors, including many well established incubators in Silicon Valley, would require non-U.S. companies to convert into Delaware C-Corps before they can fund.

Opportunities in the US market: US investors command the largest pool of venture capital in the world, providing startups with significant resources to fuel their growth. Additionally, the US market offers attractive exit opportunities through mergers, acquisitions, and initial public offerings (IPOs) on major stock exchanges like NASDAQ and NYSE. These factors have led many non-US companies to recognize the benefits of converting to Delaware C-Corps in order to tap into this wealth of investment capital and position themselves for successful exits within the dynamic US business landscape.

Steps to Flip a Non-US Company to a Delaware C-Corp

For this blog post, the foreign company looking to raise money in the US will be the "non-US Company" and the Delaware C-Corp will be the "Delaware Co." We can also assume the non-US Company has already raised a Series Seed round from investors in its home country and is now seeking to raise its Series A round in the US with participation from new and existing investors.

Step One: Incorporation of the Delaware Co.

Choose a company name: The first step is to choose a name for the Delaware Co. that is unique and not already in use by another entity in Delaware.

File a Certificate of Incorporation (COI): After choosing a name, file a Certificate of Incorporation with the Delaware Division of Corporations, providing details such as the company's name, address, registered agent, and the number and type of authorized shares. If the non-US company has existing shareholders who have claimed certain tax benefits (such as EIS and SEIS in the UK), the US counsel should collaborate with local advisors while drafting the initial COI. This will help them understand the specific requirements needed for the non-US company's shareholders to maintain their tax relief. For example, some jurisdictions require the initial Delaware COI to match as closely as possible to the articles of the non-Company pre-flip, particularly with regard to the rights of different classes of stock.

Obtain an Employer Identification Number (EIN): Apply for an EIN from the Internal Revenue Service (IRS) to facilitate tax reporting and compliance.

Adopt Bylaws: Draft and adopt Bylaws, which will define the internal governance structure and rules of the Delaware Co. This is another document that may require review by the local counsel to ensure existing shareholders don't lose their tax benefits. The Bylaws will typically be amended in Step Three (discussed below) when closing the Series A round.

Appoint directors and officers: Appoint the company's board of directors and corporate officers, in accordance with the Bylaws and mirroring those of the non-US Company. Although the lead US investor in the new round would typically ask for a board seat, they don't come in at this stage yet.

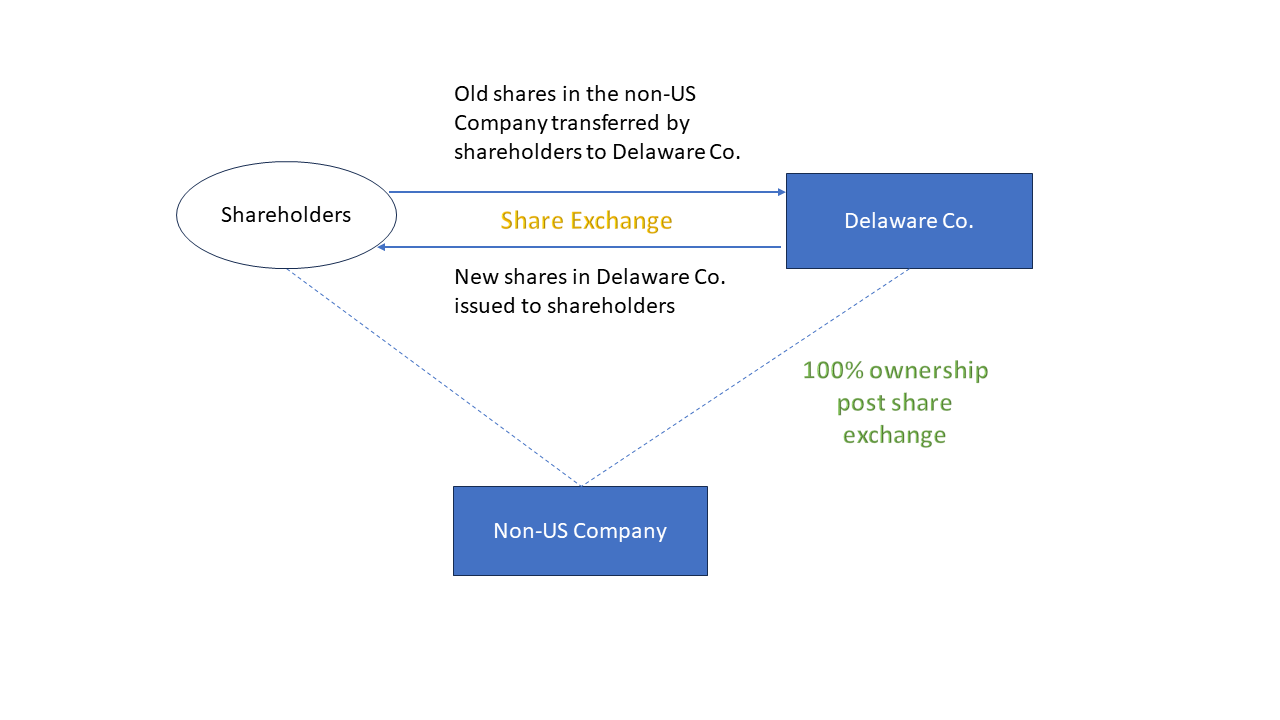

Step Two: Share Exchange

What's happening at this step is that the Delaware Co. will acquire all of the issued share capital of the non-US company in exchange for the issuance of new shares in the Delaware Co. After the share exchange is completed, the Delaware Co. will then own 100% of the non-US company and each shareholder will be left with the same proportion and class of shares in Delaware Co. as held in the non-US Company.

Draft a Share Exchange Agreement: The existing shareholders of the non-US company and the Delaware Co. will need to enter into a Share Exchange Agreement, which outlines the terms and conditions under which the existing shares will be exchanged for shares in the Delaware Co. When drafting, the deal team should also determine the appropriate exchange ratio based on the number of existing shares, company's valuation, and Series A round size. Each shareholder of the non-US company should have the same percentage of ownership of the Delaware Co. post the share exchange.

Transfer of assets and liabilities: You may wonder whether the non-US company need to transfer its assets, such as key intellectual properties, to the Delaware Co. This is a business point the Company should discuss with the Series A investors. If the company will continue to operate mostly in the ex-US jurisdiction post-closing, the US investors may not require the transfer of IPs and other assets to the Delaware Co. given it is going to own 100% of the non-US company.

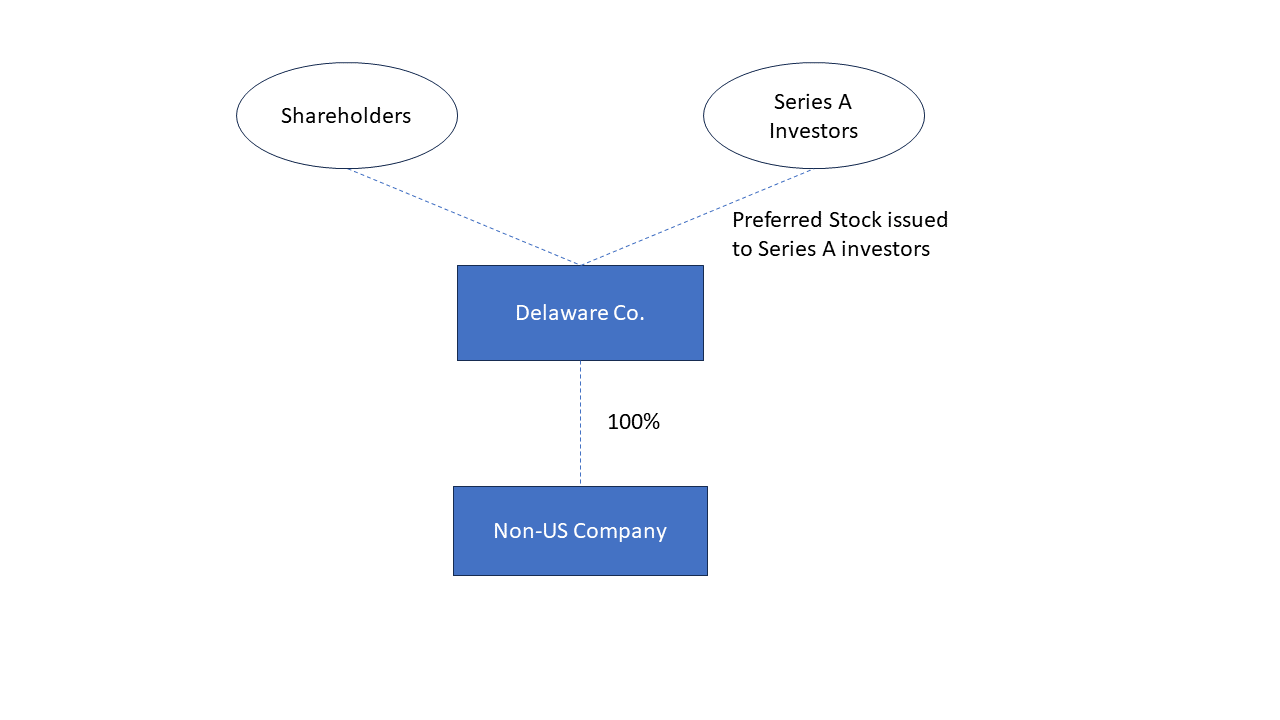

Step Three: Issuing Preferred Stock to Series A Investors

File Amended and Restated COI in Delaware: In order to issue preferred stock to new investors, the Delaware Co. will need to file an amended and restated COI in order to create a new class of shares with specific rights and preferences, such as liquidation preference, dividend rights, and voting rights. The Delaware Co. may need to create two separate classes of Preferred Stock to ensure that the Series Seed investors (often from the ex-US country) can claim the local tax benefits granted by their local tax authority in connection with purchasing new shares in a US company. Needless to say, this is another key document where lawyers and accountants from all jurisdictions need to collaborate on. For founders, it is a balancing act to make sure both the Series A investors and Series Seed investors are happy. For investors, you should weight the pros and cons of each class of Preferred Stock offered by the Delaware Co. and determine which class of Preferred Stock suits you the best.

Draft other transaction documents. US counsel should take the lead drafting the other Series A documents, including the Stock Purchase Agreement, Voting Agreement, Investors' Rights Agreement, and Right of First Refusal and Co-Sale Agreement. (See model legal documents published by National Venture Capital Association (NVCA).) If there are multiple classes of Preferred Stock, these other financing documents should reflect each class's respective liquidation preference, voting rights, anti-dilution rights etc.

Other Top Considerations

Tax Implications for Founders, Existing Investors, and New Investors

Founders should consider filing a US tax election with the IRS, known as an 83(b) election, within 30 days after they're issued stock in a US corporation subject to vesting. The 83(b) election allows founders to be taxed on the shares' value at the time of issuance, rather than as the shares vest over time. This may apply even to non-US taxpayers if they become US taxpayers while their shares are still vesting. It's definitely worth considering.

For existing investors in the non-US company, the tax implications of the flip will depend on the specific tax laws of their country of residence. Generally, the exchange of shares in the non-US company for shares in the Delaware Co. may trigger a taxable event, such as a capital gain or loss. Companies should discuss with their local accountants and tax lawyers and see whether it is possible to obtain a pre-clearance from their local tax authority before triggering the Delaware Flip.

For new investors in the Delaware Co., it is essential to understand the tax implications associated with investing in a US-based entity. Potential tax obligations may include federal and state income taxes, as well as withholding taxes on dividends and other distributions. Tax treaties between the United States and the investor's country of residence may provide relief from double taxation or reduced withholding rates. It is highly recommended that new investors consult with their tax advisors to understand the specific tax consequences based on their individual circumstances before participating in the investment round.

In short, the Delaware Flip is going to be highly driven by tax considerations. Companies and their advisors must ensure that (1) existing shareholders of the non-US company can maintain their already claimed tax benefits, and (2) purchasers of new shares in the Delaware Co. can benefit from any tax breaks offered by their local tax authorities for holding shares in a US company.

Get Approvals from Existing Investors Early

Just like raising any subsequent financing rounds, getting everyone on your current cap table to sign off on the deal structure is extremally important. Founders should communicate the plan to attract US investment early on in the process to its existing investors and explain the steps involved. Another important question to ask yourself is whether you want any non-US investor to write you a big check. Just like US investors prefer Delaware C-Corps., some ex-US investors may only want to invest in companies organized under their domestic laws. If those investors are going to be your main target, you should think twice before doing a Delaware Flip.

Conclusion

Flipping a non-US company to a Delaware C-Corp can be an effective strategy for attracting investment from US investors. However, the process involves several steps, including setting up the Delaware Co., conducting a share exchange, issuing preferred stock to new investors, and most importantly making sure all classes of shareholders are happy with the steps to be taken and the end result. It's important to assemble a team of good advisors, including lawyers and accountants, both in your home country and in the US to preview any issue that may arise before entering into any deal with US investors.